Article Index

Starting a business

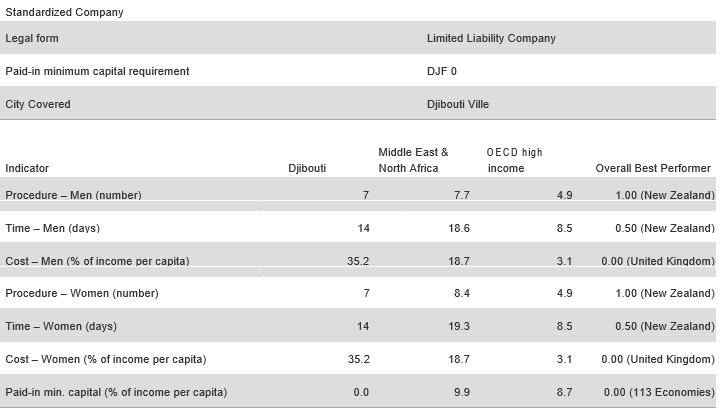

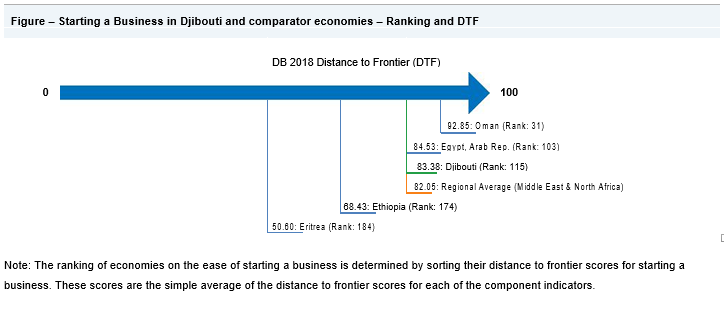

Procedures, time, cost and paid-in minimum capital to start a limited liability company

This topic measures the paid-in minimum capital requirement, number of procedures, time and cost for a small- to medium-sized limited liability company to start up and formally operate in economy’s largest business city.This topic measures the paid-in minimum capital requirement, number of procedures, time and cost for a small- to medium-sized limited liability company to start up and formally operate in economy’s largest business city.

To make the data comparable across 190 economies, Doing Business uses a standardized business that is 100% domestically owned, has start-up capital equivalent to 10 times income per capita, engages in general industrial or commercial activities and employs between 10 and 50 people one month after the commencement of operations, all of whom are domestic nationals. Starting a Business considers two types of local limited liability companies that are identical in all aspects, except that one company is owned by 5 married women and the other by 5 married men. The distance to frontier score for each indicator is the average of the scores obtained for each of the component indicators.

The latest round of data collection for the project was completed in June 2017. See the methodology for more information.

|

What the indicators measure |

Case study assumptions |

|

Procedures to legally start and operate a company (number)

Time required to complete each procedure (calendar days)

Cost required to complete each procedure (% of income per capita)

Paid-in minimum capital (% of income per capita)

|

To make the data comparable across economies, several assumptions about the business and the procedures are used. It is assumed that any required information is readily available and that the entrepreneur will pay no bribes. The business: - Is a limited liability company (or its legal equivalent). If there is more than one type of limited liability company in the economy, the most common among domestic rms is chosen. Information on the most common form is obtained from incorporation lawyers or the statistical o ce. - Operates in the economy’s largest business city and the entire o ce space is approximately 929 square meters (10,000 square feet). For 11 economies the data are also collected for the second largest business city. - Is 100% domestically owned and has ve owners, none of whom is a legal entity; and has a start-up capital of 10 times income per capita and has a turnover of at least 100 times income per capita. - Performs general industrial or commercial activities, such as the production or sale of goods or services to the public. The business does not perform foreign trade activities and does not handle products subject to a special tax regime, for example, liquor or tobacco. It does not use heavily polluting production processes. - Leases the commercial plant or o ces and is not a proprietor of real estate and the amount of the annual lease for the o ce space is equivalent to 1 times income per capita.

The owners:

|

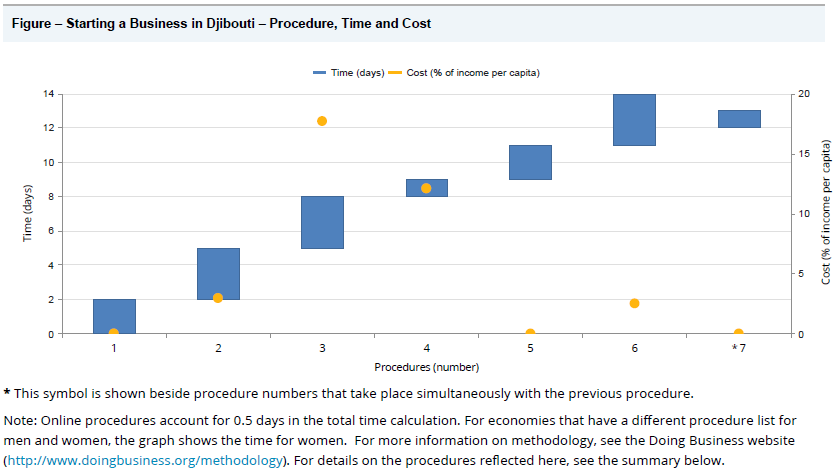

| No. | Procedures | Time to Complete | Associated Costs |

| 1 | Deposit the initial capital at the bank and obtain a receipt Agency : Bank The bank must check the origin of the funds and the purpose of the initial capital. The parties must submit a document stating their intent to start a new business. If during the company’s life the capital should change, the company’s registrar must be noti ed. |

2 days | No charge |

| 2 |

Draft the company's articles of association with a lawyer When the statutes are drafted by a notary, the average cost is 100,000 FCFA. |

3 days | DFJ 10,000 |

| 3 | Register articles of association with the Direction des Impôts

Agency : Service des Impots

|

3 days on average | DJF 50 000 for a capital of less than DJF 10 millions + DJF 1000 per page stamp duties (10 pages). |

| 4 | Reserve the company name, register with the Companies Registry and

publish the notice of commencement of activity the Companies Registry, at the O ce djiboutien de la propriété Industrielle et commerciale (ODPIC), the following documents are required: - forms CN1 and RC1 |

1 day |

DJF 18,000 registration fees (immatriculation), DJF 18,000 for the publication and DJF 5000 name reservation

|

| 5 |

Register for taxes and obtain professional license (patente) Agency: Tax Administration Entrepreneurs must go to the Service des Patentes to obtain a license, using the registration number obtained at the registrar. This registration also serves as tax registration. Companies from class 5 to 8 are exempted from paying the professional license fees during the first three years of the company. |

2 days | No charge |

| 6 | Create a company seal, letterhead and books

Agency : Seal-making shop Creating a company seal, letterhead and books can be done at the Seal-maker for DJF 2000 - 3000 (for seal and letterhead) + DJF 5000 - 7000 (books). |

3 days | DJF 2,000 - 3,000 (for seal and letterhead) + DJF 5,000 - 7,000 (books) |

| 7 | Register employees with the Caisse Nationale de la Sécurité Sociale Agency : Caisse Nationale de la Sécurité Sociale

The Company must register and register each employee to the Social Security. |

1 day (simultaneous with previous procedure) | No charge |