About Doing Business

The Doing Business project provides objective measures of business regulations and their enforcement across 190 economies and selected cities at the subnational and regional level.

The Doing Business project, launched in 2002, looks at domestic small and medium-size companies and measures the regulations applying to them through their life cycle.

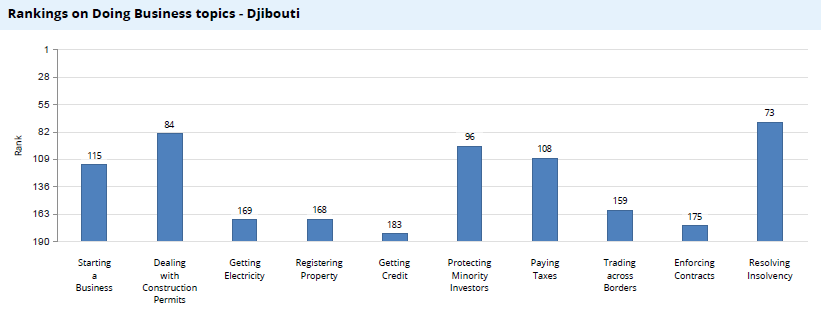

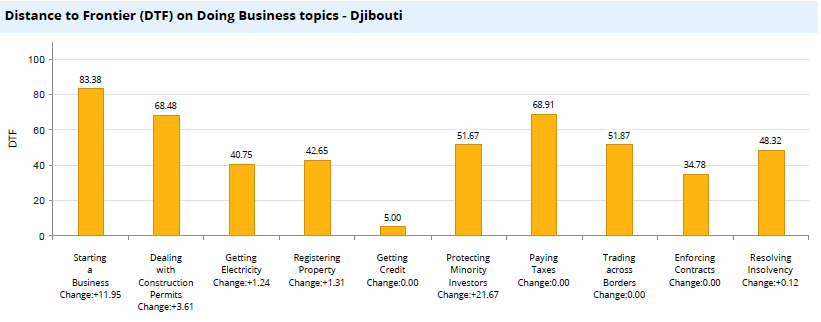

Doing Business captures several important dimensions of the regulatory environment as it applies to local rms. It provides quantitative indicators on regulation for starting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting minority investors, paying taxes, trading across borders, enforcing contracts and resolving insolvency. Doing Business also measures features of labor market regulation. Although Doing Business does not present rankings of economies on the labor market regulation indicators or include the topic in the aggregate distance to frontier score or ranking on the ease of doing business, it does present the data for these indicators.

By gathering and analyzing comprehensive quantitative data to compare business regulation environments across economies and over time, Doing Business encourages economies to compete towards more e cient regulation; o ers measurable benchmarks for reform; and serves as a resource for academics, journalists, private sector researchers and others interested in the business climate of each economy.

In addition, Doing Business o ers detailed subnational reports, which exhaustively cover business regulation and reform in di erent cities and regions within a nation. These reports provide data on the ease of doing business, rank each location, and recommend reforms to improve performance in each of the indicator areas. Selected cities can compare their business regulations with other cities in the economy or region and with the 190 economies that Doing Business has ranked.

The first Doing Business report, published in 2003, covered 5 indicator sets and 133 economies. This year’s report covers 11 indicator sets and 190 economies. Most indicator sets refer to a case scenario in the largest business city of each economy, except for 11 economies that have a population of more than 100 million as of 2013 (Bangladesh, Brazil, China, India, Indonesia, Japan, Mexico, Nigeria, Pakistan, the Russian Federation and the United States) where Doing Business, also collected data for the second largest business city. The data for these 11 economies are a population-weighted average for the 2 largest business cities. The project has bene ted from feedback from governments, academics, practitioners and reviewers. The initial goal remains: to provide an objective basis for understanding and improving the regulatory environment for business around the world.

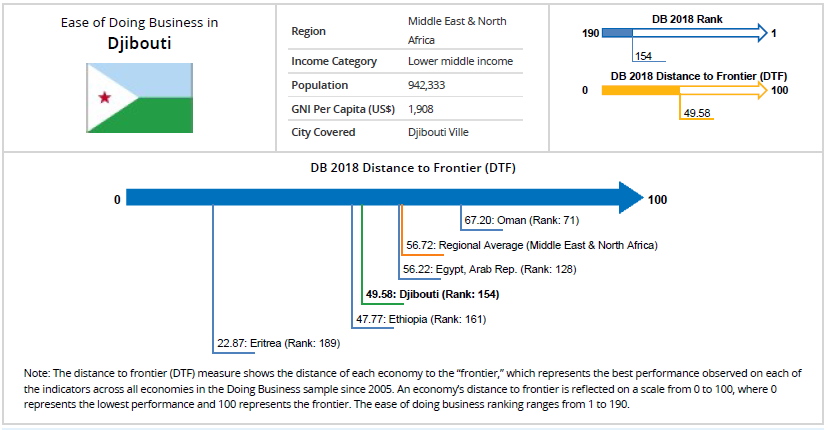

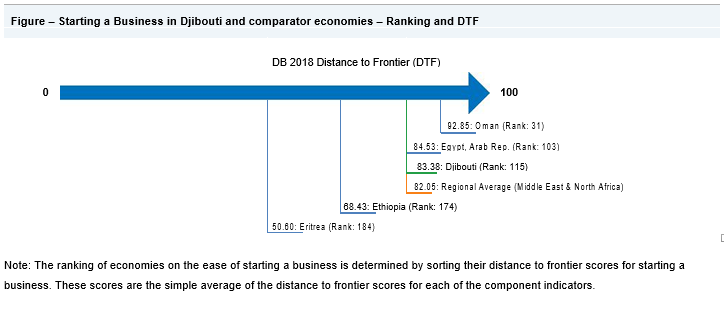

The distance to frontier (DTF) measure shows the distance of each economy to the “frontier,” which represents the best performance observed on each of the indicators across all economies in the Doing Business sample since 2005. An economy’s distance to frontier is re ected on a scale from 0 to 100, where 0 represents the lowest performance and 100 represents the frontier. The ease of doing business ranking ranges from 1 to 190. The ranking of 190 economies is determined by sorting the aggregate distance to frontier scores, rounded to two decimals.

Starting a business

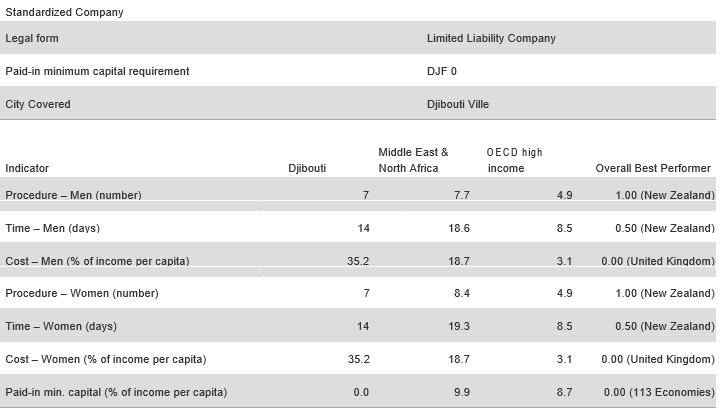

Procedures, time, cost and paid-in minimum capital to start a limited liability company

This topic measures the paid-in minimum capital requirement, number of procedures, time and cost for a small- to medium-sized limited liability company to start up and formally operate in economy’s largest business city.This topic measures the paid-in minimum capital requirement, number of procedures, time and cost for a small- to medium-sized limited liability company to start up and formally operate in economy’s largest business city.

To make the data comparable across 190 economies, Doing Business uses a standardized business that is 100% domestically owned, has start-up capital equivalent to 10 times income per capita, engages in general industrial or commercial activities and employs between 10 and 50 people one month after the commencement of operations, all of whom are domestic nationals. Starting a Business considers two types of local limited liability companies that are identical in all aspects, except that one company is owned by 5 married women and the other by 5 married men. The distance to frontier score for each indicator is the average of the scores obtained for each of the component indicators.

The latest round of data collection for the project was completed in June 2017. See the methodology for more information.

|

What the indicators measure |

Case study assumptions |

|

Procedures to legally start and operate a company (number)

Time required to complete each procedure (calendar days)

Cost required to complete each procedure (% of income per capita)

Paid-in minimum capital (% of income per capita)

|

To make the data comparable across economies, several assumptions about the business and the procedures are used. It is assumed that any required information is readily available and that the entrepreneur will pay no bribes. The business: - Is a limited liability company (or its legal equivalent). If there is more than one type of limited liability company in the economy, the most common among domestic rms is chosen. Information on the most common form is obtained from incorporation lawyers or the statistical o ce. - Operates in the economy’s largest business city and the entire o ce space is approximately 929 square meters (10,000 square feet). For 11 economies the data are also collected for the second largest business city. - Is 100% domestically owned and has ve owners, none of whom is a legal entity; and has a start-up capital of 10 times income per capita and has a turnover of at least 100 times income per capita. - Performs general industrial or commercial activities, such as the production or sale of goods or services to the public. The business does not perform foreign trade activities and does not handle products subject to a special tax regime, for example, liquor or tobacco. It does not use heavily polluting production processes. - Leases the commercial plant or o ces and is not a proprietor of real estate and the amount of the annual lease for the o ce space is equivalent to 1 times income per capita.

The owners:

|

| No. | Procedures | Time to Complete | Associated Costs |

| 1 | Deposit the initial capital at the bank and obtain a receipt Agency : Bank The bank must check the origin of the funds and the purpose of the initial capital. The parties must submit a document stating their intent to start a new business. If during the company’s life the capital should change, the company’s registrar must be noti ed. |

2 days | No charge |

| 2 |

Draft the company's articles of association with a lawyer When the statutes are drafted by a notary, the average cost is 100,000 FCFA. |

3 days | DFJ 10,000 |

| 3 | Register articles of association with the Direction des Impôts

Agency : Service des Impots

|

3 days on average | DJF 50 000 for a capital of less than DJF 10 millions + DJF 1000 per page stamp duties (10 pages). |

| 4 | Reserve the company name, register with the Companies Registry and

publish the notice of commencement of activity the Companies Registry, at the O ce djiboutien de la propriété Industrielle et commerciale (ODPIC), the following documents are required: - forms CN1 and RC1 |

1 day |

DJF 18,000 registration fees (immatriculation), DJF 18,000 for the publication and DJF 5000 name reservation

|

| 5 |

Register for taxes and obtain professional license (patente) Agency: Tax Administration Entrepreneurs must go to the Service des Patentes to obtain a license, using the registration number obtained at the registrar. This registration also serves as tax registration. Companies from class 5 to 8 are exempted from paying the professional license fees during the first three years of the company. |

2 days | No charge |

| 6 | Create a company seal, letterhead and books

Agency : Seal-making shop Creating a company seal, letterhead and books can be done at the Seal-maker for DJF 2000 - 3000 (for seal and letterhead) + DJF 5000 - 7000 (books). |

3 days | DJF 2,000 - 3,000 (for seal and letterhead) + DJF 5,000 - 7,000 (books) |

| 7 | Register employees with the Caisse Nationale de la Sécurité Sociale Agency : Caisse Nationale de la Sécurité Sociale

The Company must register and register each employee to the Social Security. |

1 day (simultaneous with previous procedure) | No charge |

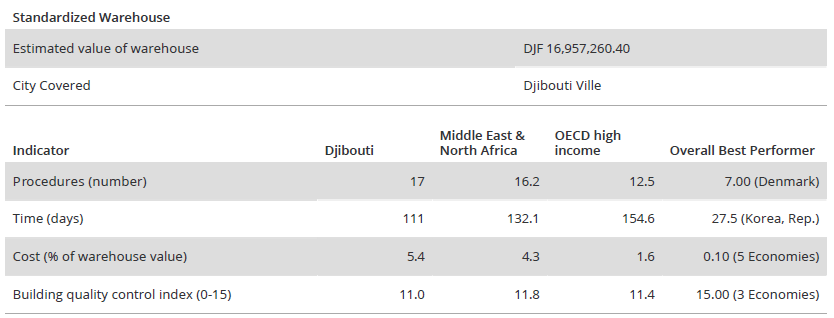

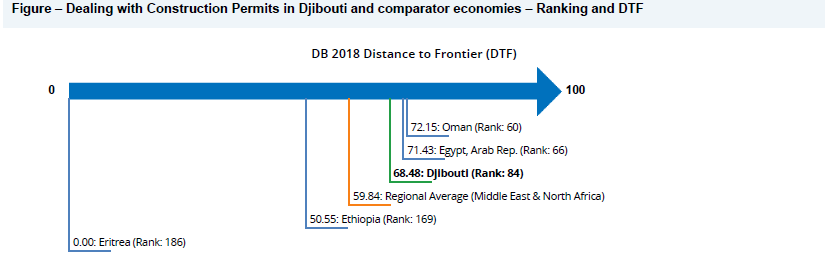

Dealing with construction permits

Procedures, time and cost to complete all formalities to build a warehouse and the quality control and safety mechanisms in the construction permitting system

This topic tracks the procedures, time and cost to build a warehouse—including obtaining necessary the licenses and permits,This topic tracks the procedures, time and cost to build a warehouse—including obtaining necessary the licenses and permits,submitting all required noti cations, requesting and receiving all necessary inspections and obtaining utility connections. Inaddition, the Dealing with Construction Permits indicator measures the building quality control index, evaluating the quality ofbuilding regulations, the strength of quality control and safety mechanisms, liability and insurance regimes, and professionalcerti cation requirements. The most recent round of data collection was completed in June 2017.

| What the indicators measure | Case study assumptions |

|

Procedures to legally build a warehouse (number) Submitting all relevant documents and obtaining all necessary clearances, licenses, permits and certificates Submitting all required notifications and receiving all necessary inspections Obtaining utility connections for water and sewerage Registering and selling the warehouse after its completion Time required to complete each procedure (calendar days) Does not include time spent gathering information Each procedure starts on a separate day— though procedures that can be fully completed online are an exception to this rule Procedure is considered completed once final document is received No prior contact with officials Cost required to complete each procedure (% of warehouse value) Official costs only, no bribes Building quality control index (0-15) Sum of the scores of six component indices: Quality of building regulations (0-2) Quality control before construction (0-1) Quality control during construction (0-3) Quality control after construction (0-3) Liability and insurance regimes (0-2) Professional certifications (0-4) |

To make the data comparable across economies, several assumptions about the construction company, the warehouse project and the utility connections are used. The construction company (BuildCo): - Is a limited liability company (or its legal equivalent) and operates in the economy’s largest business city . For 11 economies the data are also collected for the second largest business city. - Is 100% domestically and privately owned; has ve owners, none of whom is a legal entity. Has a licensed architect and a licensed engineer, both registered with the local association of architects or engineers. BuildCo is not assumed to have any other employees who are technical or licensed experts, such as geological or topographical experts. - Owns the land on which the warehouse will be built and will sell the warehouse upon its completion. The warehouse:

approximately 1,300.6 square meters (14,000 square feet). Each oor will be 3 meters (9 feet, 10 inches) high and will be located on a land plot of approximately 929 square meters (10,000 square feet) that is 100% owned by BuildCo, and the warehouse is valued at 50 times income per capita.

The water and sewerage connections:

average wastewater ow of 568 liters (150 gallons) a day. Will have a peak water use of 1,325 liters (350 gallons) a day and a peak wastewater ow of 1,136 liters (300 gallons) a day. - W i l l h a v e a c o n s t a n t l e v e l o f w a t e r d e m a n d a n d w a s t e w a t e r o w throughout the year; will be 1 inch in diameter for the water connection and 4 inches in diameter for the sewerage connection. |

Note: The ranking of economies on the ease of dealing with construction permits is determined by sorting their distance to frontierNote: The ranking of economies on the ease of dealing with construction permits is determined by sorting their distance to frontierscores for dealing with construction permits. These scores are the simple average of the distance to frontier scores for each of thecomponent indicators.

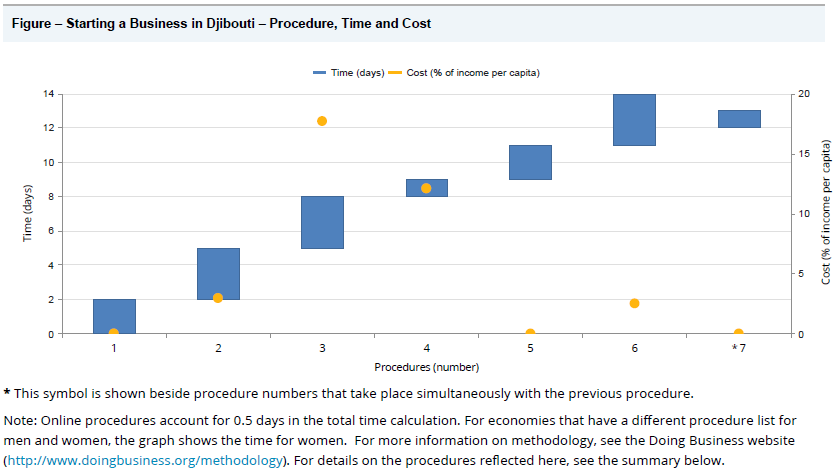

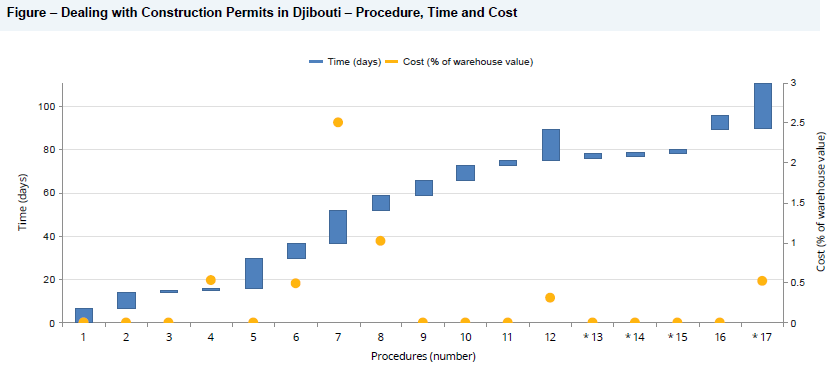

* This symbol is shown beside procedure numbers that take place simultaneously with the previous procedure.* This symbol is shown beside procedure numbers that take place simultaneously with the previous procedure.Note: Online procedures account for 0.5 days in the total time calculation. For economies that have a di erent procedure list formen and women, the graph shows the time for women. For more information on methodology, see the Doing Business website(http://www.doingbusiness.org/methodology). For details on the procedures re ected here, see the summary below.

| Number | Procedures | Time to Complete | Associated Costs |

| 1 |

Obtain lot plan and a certificate of registration

Agency: Cadastre - Direction des Domaines et Conservation foncière

BuildCo must obtain a certified zoning map and a certi cate of registration in order to apply for a permis de remblai.

|

7 days | No charge |

| 2 |

Apply and obtain a "permis de remblai" (embankment) at the DirectionApply and obtain a "permis de remblai" (embankment) at the Directionde l'Habitat et l'Urbanisme Agency : Department of Housing and Urban Development (Direction del'Habitat et l'Urbanisme)To apply and obtain an embankment permit, BuildCo must submit: • A letter • A registration certificate issued by the Direction des Domaines et de laConservation Fonciere • A location plan/urbanisme plan issued by the cadastre service at theDirection des Domaines et de la Conservation FonciereUpon this request, the Direction de l'Habitat et l'Urbanisme will issue a"permis de remblai" and its volume. |

7 days | No charge |

| 3 |

Register articles of association with the Direction des ImpôtsRegister articles of association with the Direction des Impôts Agency : Service des Impots All new companies must register statutes with the Direction des Impôts. |

1 day | No charge |

| 4 | Receive inspection to verify the compactness of the embankment from the LBCE

Agency : LBCE- Laboratoire Central du Bâtiment et de l'Equipement

The LBCE -- Laboratoire Central du Bâtiment et de l'Equipement -- will inspect the embankment. The cost that LBCE offers for a test of compactness is DJF 6,000.00 for every 200 sq. m. at a depth of 30 cm.

It is assumed that BuildCo will request a depth of 90 cm. Therefore for a plot of land of 929 sq. m. and a compactness of 0.9 m, the cost paid by BuildCo's would be land (DJF 6,000.00 * (5 * 3)) = DJF 90,000.00.

If LBCE is satis ed that the compactness is adequate, they will transmit the signed request to DHU for the issuance of the certificate of compliance for the embankment.

|

1 day | DFJ 90,000 |

| 5 | Obtain certificate of compliance for the embankment (certificat de conformite de remblai)

Agency : Direction de l'Habitat et l'Urbanisme

Once the signed document from LBCE is received, the Direction de l'Habitat et l'Urbanisme will issue the certificate of compliance (certificat de conformité de remblai) for BuildCo.

|

14 days | No charge |

| 6 |

Request and obtain nal ground plans (plan de masse cadastral)

Agency : Sous Direction de la Conservation Foncière (de la Direction des Domaines et de la Conservation Foncière)

After obtaining the permit and certi cate of compliance for the embankment, BuildCo must request and obtain the final ground plans at the Sous Direction de la Conservation Foncière (de la Direction des Domaines et de la Conservation Foncière). A tax on embankment must be paid: DJF 100.00 per cubic meter.

This map de nes the boundaries of the land and must be attached to the application for the building permit, or else the application will not be accepted by the DHU. Sub-Directorate of Lands and Land Conservation will identify a date to issue the Plan de Masse Cadastral and the final pegs installation on the lot.

|

7 days | DFJ 83,610 |

| 7 | Obtain building permit Agency : Direction de l'Habitat et l'Urbanisme BuildCo must submit 6 copies of the le for the building permit request to the DHU (Direction de l'Habitat et l'Urbanisme). The 2.5% tax that the company must pay is divided as follows: • 1.5% for analysis of the request for the building permit • 1.0% for the surveillance of the concrete structure (study and works) |

15 days | DFJ 423,932 |

| 8 | Receive first concrete test from the LBCE- Laboratoire Central du Bâtiment et de l'Equipement Agency : LBCE- Laboratoire Central du Bâtiment et de l'Equipement Construction testing occurs at each phase of the building process. Concrete crushing test is done at 7 days, then at 14 days and nal one at 21 days. |

7 days | DFJ 172,800 |

| 9 | Receive second resistance test from the LBCE- Laboratoire Central du Bâtiment et de l'Equipement Agency : LBCE- Laboratoire Central du Bâtiment et de l'Equipement This is the second concrete crushing test done 7 days after the rst one. |

7 days | No charge |

| 10 | Receive nal resistance test from the LBCE- Laboratoire Central du Bâtiment et de l'Equipement Agency : LBCE- Laboratoire Central du Bâtiment et de l'Equipement This is the final concrete crushing test done 7 days after the second test was done. |

7 days | No charge |

| 11 | Request and receive an earthquake certificate issued by the Direction de l'Habitat et l'Urbanisme Agency : Direction de l'Habitat et l'Urbanisme To obtain the certi cate of conformity after construction is complete, it is mandatory to obtain an earthquake certificate issued by the Direction de l'Habitat et l'Urbanisme. BuildCo can request this certi cate by visiting the agency in person. The earthquake certificate is obtained as soon as the different slabs have been casted from the Sous-Direction Contrôle de la Direction de l'Habitat et de l'Urbanisme on the basis of "good casting." The certificate is issued the next day after verification of compliance with seismic standards. BuildCo does not have to wait for the completion of the construction to request this certificate. |

2 days | No charge |

| 12 | Request and receive foundation inspection from the Direction de l'Habitat et l'Urbanisme, Sous-direction Contrôle et Réglementation Agency : Direction de l'Habitat et l'Urbanisme, Sous-direction Contrôle et Réglementation The works begin when the concrete plans are accepted by the Sous-direction Contrôle et Réglementation. An inspection takes place when slabs are laid. This procedure is not mandatory but is standard practice. |

14 days | USD 300 |

|

>> 13 |

Request and receive an electrical certi cate of compliance

Agency : Direction de l'Habitat et l'Urbanisme

To obtain the certi cate of conformity after construction is complete, it is mandatory to obtain an electrical certificate of compliance issued by the Department of Housing and Urban Development. The electrical certificate of compliance can be requested once the internal wiring is done in compliance with the standards. Officers from the Sous-Direction de l'Urbanisme will conduct a site visit and the electrician will explain the internal wiring to the o cers. The inspection takes place one day after the request for the certi cate of compliance. After 1-2 days, the Sous-Direction de l'Urbanisme issues the electrical certificate of compliance.

|

2 days | No charge |

| >> 14 |

Request and receive an alignment certificate

Agency : Direction des Domaines et de la Conservation Foncière

To obtain the certi cate of conformity after construction is complete, it is mandatory to obtain an alignment certificate issued by the Direction des Domaines et de la Conservation Foncière.

|

2 days | No charge |

| >> 15 |

Request and receive the sanitary certificate issued by the National Institute of Public Health

Agency : National Institute of Public Health (l’Institut National de Santé Publique de Djibouti)

To obtain the certificate of conformity after construction is complete, it is mandatory to obtain sanitary certificate for the septic tank issued by the National Institute of Public Health in Djibouti.

|

2 days | No charge |

| 16 |

Submit all certificates of compliance and obtain final certificate of compliance (certificat de conformité) Agency : Ministry of Housing (Ministère de l’Habitat)Compliance of new construction is confirmed by the issuance of a Certificateof General Conformity issued by the Department of Housing and Urban Development at the end of the work.This certificate attests the conformity of the building in accordance to theapproved building permit. Several compliance certificates must be submitted: earthquake, sanitation, alignment, foundation and electrical. |

7 days | No charge |

| >> 17 |

Request and receive water and sewage connectionRequest and receive water and sewage connection Agency : Office Nationale des Eaux de Djibouti (ONEAD) For the sewage network a health certificate is issued by the Department of Epidemiology and Health Information, which is obtained in procedure 15. The water company provides the meter at no charge and BuildCo lays downthe pipes to connect it to the main line. |

21 days | USD 500 |

>> Takes place simultaneously with previous procedure.

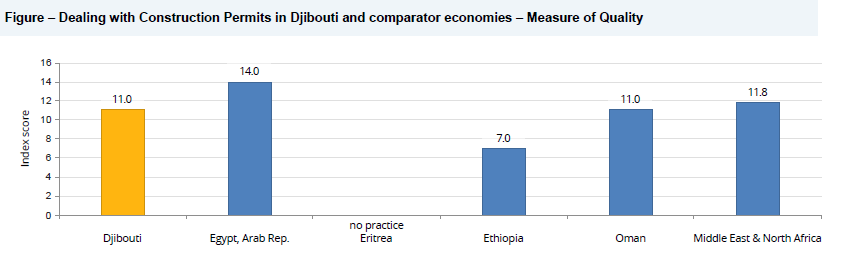

Details – Dealing with Construction Permits in Djibouti – Measure of Quality

| Answer | Score | |

|---|---|---|

| Building quality control index (0-15) | 11.0 | |

| Quality of building regulations index (0-2) | 2.0 | |

| How accessible are building laws and regulations in your economy? (0-1) | Available online; Free of charge; In official gazette. | 1.0 |

| Which requirements for obtaining a building permit are clearly speci ed in the building regulations or on any accessible website, brochure or pamphlet? (0-1) |

List of required documents; Fees to be paid; Required preapprovals. | 1.0 |

| Which requirements for obtaining a building permit are clearly speci ed in the building regulations or on any accessible website, brochure or pamphlet? (0-1) |

List of required documents; Fees to be paid; Required preapprovals. | 1.0 |

| Quality control before construction index (0-1) | 1.0 | |

| Which third-party entities are required by law to verify that the building plans are incompliance with existing building regulations? (0-1) | Licensed engineer. | 1.0 |

| Quality control during construction index (0-3) | 2.0 | |

| What types of inspections (if any) are required by law to be carried out during construction? (0-2) | Inspections at various phases; Risk-based inspections. | 2.0 |

| Do legally mandated inspections occur in practice during construction? (0-1) | Mandatory inspections are not always done in practice during construction; Mandatory inspections are done most of the time during construction. |

0.0 |

| Quality control after construction index (0-3) | 3.0 | |

| Is there a final inspection required by law to verify that the building was built in accordance with the approved plans and regulations? (0-2) |

Yes, in-house engineer submits report for final inspection. | 2.0 |

| Do legally mandated nal inspections occur in practice? (0-1) |

Final inspection always occurs in practice.

|

1.0 |

| Liability and insurance regimes index (0-2) | 1.0 | |

| Which parties (if any) are held liable by law for structural aws or problems in thebuilding once it is in use (Latent Defect Liability or Decennial Liability)? (0-1) | Architect or engineer; Professional in charge of the supervision; Construction company. | 1.0 |

| Which parties (if any) are required by law to obtain an insurance policy to cover possible structural aws or problems in the building once it is in use (Latent Defect Liability Insurance or Decennial Insurance)? (0-1) | No party is required by law to obtain insurance . | 0.0 |

| Professional certifications index (0-4) | 2.0 | |

| What are the qualification requirements for the professional responsible for verifying that the architectural plans or drawings are in compliance with existing building regulations? (0-2) |

Minimum number of years of experience; University degree in architecture or engineering. |

1.0 |

| What are the qualification requirements for the professional who supervises the construction on the ground? (0-2) | Minimum number of years of experience; University degree in engineering, construction or construction management. | 1.0 |

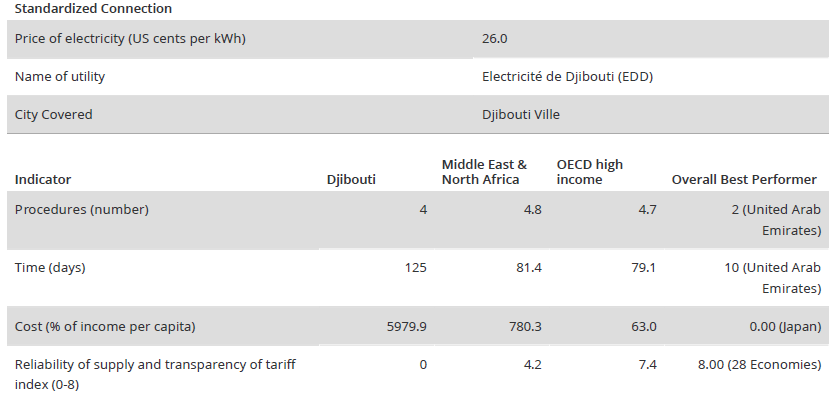

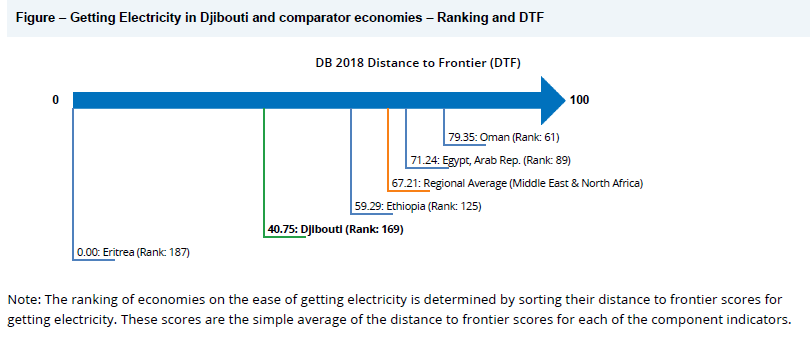

Getting electricity

Procedures, time and cost to get connected to the electrical grid, the reliability of the electricity supply and the transparency of tariffs

This topic measures the procedures, time and cost required for a business to obtain a permanent electricity connection for a newlyconstructed warehouse. Additionally, the reliability of supply and transparency of tari s index measures reliability of supply,transparency of tari s and the price of electricity. The most recent round of data collection for the project was completed in June2017. See the methodology for more information.

| What the Indicators Measure | Case Study Assumptions |

Procedures to obtain an electricity connection (number)

Time required to complete each procedure (calendar days)

Cost required to complete each procedure (% of income per capita)

The reliability of supply and transparency of tariffs index (0-8)

Price of electricity (cents per kilowatt-hour)*

*Note: Doing Business measures the price of electricity, but it is not included in the distance to frontier score nor the ranking on the ease of getting electricity. |

To make the data comparable across economies, several assumptions are used. The warehouse: The electricity connection: The monthly consumption: |

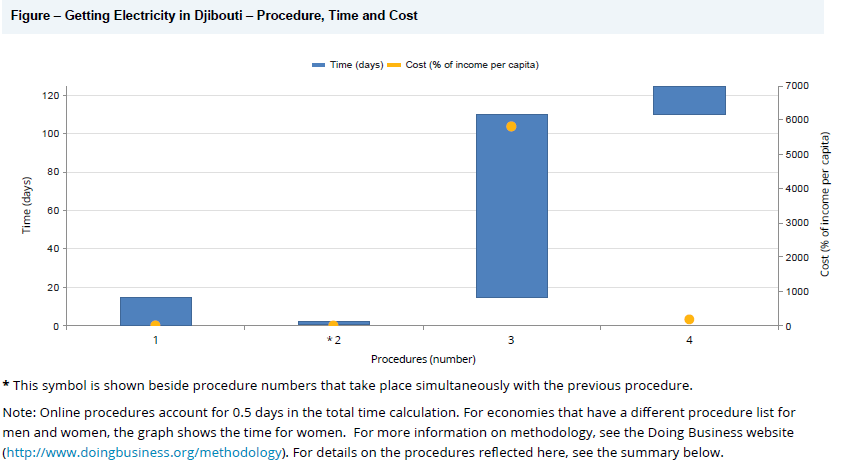

| Number | Procedures | Time to Complete | Associated Costs |

| 1 | Submit application to Electricité de Djibouti and await estimate Agency : Electricité de Djibouti (EDD) The application is typically submitted to Electricité de Djibouti (EDD) in person. A detailed load schedule should be attached to the application, along with a copy of the construction permit. Once the application is lodged, an engineer from EDD will need to come on site to do a feasibility study. Following this step, the quote will be sent to the customer. |

15 calendar days | DJF 0 |

| >> 2 | Receive external inspection by Electricité de Djibouti Agency : Electricité de Djibouti (EDD) Electricité de Djibouti (EDD) inspects the site and prepares an estimate for the connection fees. |

1 calendar day | DJF 0 |

| 3 | Obtain external works from Electricité de Djibouti Agency : Electricité de Djibouti (EDD) After paying the connection fees, the client needs to wait for Electricité de Djibouti (EDD) to obtain all the material. And for an electricity connection for the warehouse considered in this case study, a unit substation is needed. |

95 calendar days | DJF 19,675,428 |

| 4 | Sign supply contract and obtain meter installation and final connection Agency : Electricité de Djibouti (EDD) When the external works are completed and the client has signed a supply contract, Electricité de Djibouti (EDD) inspects the internal wiring (but not in its entirety) and installs the meter. |

15 calendar days | DJF 604,969 |

>> Takes place simulatenously with the previous procedure.

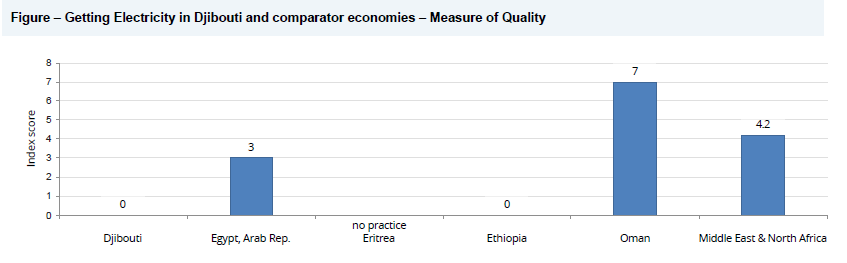

Details – Getting Electricity in Djibouti – Measure of Quality

| Answer | |

| Reliability of supply and transparency of tariff index (0-8) | 0 |

| Total duration and frequency of outages per customer a year (0-3) | 0 |

| System average interruption duration index (SAIDI) | .. |

| System average interruption frequency index (SAIFI) | .. |

| What is the minimum outage time (in minutes) that the utility considers for the calculation of SAIDI/SAIFI | N/A |

| Mechanisms for monitoring outages (0-1) | 1 |

| Does the distribution utility use automated tools to monitor outages? | Yes |

| Mechanisms for restoring service (0-1) | 1 |

| Does the distribution utility use automated tools to restore service? | Yes |

| Regulatory monitoring (0-1) | 0 |

| Does a regulator—that is, an entity separate from the utility—monitor the utility’s performance onreliability of supply? | No |

| Financial deterrents aimed at limiting outages (0-1) | 0 |

| Does the utility either pay compensation to customers or face fines by the regulator (or both) if outagesexceed a certain cap? | No |

| Communication of tariffs and tariff changes (0-1) | 1 |

| Are effective tariffs available online? | Yes |

| Link to the website, if available online |

http://www.edd.dj/eddweb/upload/tarif_2016.pdf |

| Are customers noti ed of a change in tari ahead of the billing cycle? | Yes |

Note: If the duration and frequency of outages is 100 or less, the economy is eligible to score on the Reliability of supply and transparency of tariff index.

If the duration and frequency of outages is not available, or is over 100, the economy is not eligible to score on the index.

If the minimum outage time considered for SAIDI/SAIFI is over 5 minutes, the economy is not eligible to score on the index.

Registering property

Procedures, time and cost to transfer a property and the quality of the land administration system

Getting credit

Movable collateral laws and credit information systems

Protecting minority investors

Minority shareholders’ rights in related-party transactions and in corporate governance

Paying taxes

Payments, time and total tax rate for a firm to comply with all tax regulations as well as post-filing processes

Trading across borders

Time and cost to export the product of comparative advantage and import auto parts

Enforcing contracts

Time and cost to resolve a commercial dispute and the quality of judicial processes

Resolving insolvency

Time, cost, outcome and recovery rate for a commercial insolvency and the strength of the legal framework for insolvency

Labor market regulation

Flexibility in employment regulation and aspects of job quality